In the intricate world of automotive pricing, the sticker price is just the tip of the iceberg. Beneath the surface lies a significant revenue stream and customer cost driver: Car Options. While list prices and discounts are commonly scrutinized, the often-overlooked realm of optional features can add thousands to the final bill, impacting both consumer spending and OEM profitability.

Drawing upon data from JATO’s Transaction Analysis and Volumes solutions, this article delves into the evolving landscape of car options within the EU5 (Germany, Great Britain, France, Italy, and Spain). We will explore current trends across brands, powertrains, and vehicle segments, shedding light on how car options are shaping OEM product and pricing strategies in today’s dynamic market.

The Revenue Powerhouse of Car Options

Car options encompass any additional features that augment a vehicle’s standard equipment. This broad category includes individual upgrades, bundled packages, premium paint selections, enhanced seating, and a wide array of personalized choices. For our analysis, “car options” are defined as any features purchased alongside a new car that generate supplementary revenue for the manufacturer.

Data compiled by JATO, derived from hundreds of thousands of transactions across the major European markets, underscores the substantial profit potential inherent in optional add-ons. In 2024 (Year-to-Date July), European car buyers added an average of 2.9 options to each new vehicle order, boosting the average sale price by €2,154. With 5.5 million new passenger cars registered in the EU5 during this period, car options generated an estimated turnover of nearly €12 billion in just the first half of the year. This highlights the significant financial impact of car options on the automotive industry.

Source: JATO Transaction Analysis Orders 5MM YTD July 2024. Analysis of car options uptake in the EU5 automotive market.

However, recent years have witnessed a subtle shift in consumer behavior, with a slight decrease in the average number of options selected per vehicle. This evolving trend reflects a dual approach from automakers: some brands are incorporating more features as standard, streamlining the option selection process, while others maintain a wide spectrum of customizable choices to cater to diverse customer preferences. Despite this ongoing evolution, the overall revenue contribution from car options remains a critical factor in OEM financial performance.

From Optional Extras to Product Enrichment: A Strategy Shift

Examining transactional data over the past three years reveals an interesting dynamic. While the average retail price of cars in the EU5 has increased by 6.7%, consumer spending on car options has concurrently decreased. In 2021, new car buyers selected an average of 4.4 options, representing €2,871 in added cost, which accounted for approximately 8% of the total vehicle retail price. Fast forward to today, and the average revenue generated from options has declined by €717, now constituting around 6% of the retail price.

This shift can be partially attributed to the growing trend of “product enrichment.” Automakers are increasingly focusing on enhancing the standard equipment levels of their vehicles. By incorporating features that were previously optional into the base models, they reduce the perceived need for customers to add extras.

A compelling example of this product enrichment strategy can be observed in parking assistance systems in Germany. In 2021, 93% of cars sold in Germany were equipped with rear parking distance control. Of these, 43% had it as standard, while 50% purchased it as an option. By 2024, the landscape had changed significantly. The proportion of cars with standard rear parking sensors jumped to 60%, while the option uptake decreased to 36%. Similarly, standard navigational systems have become more prevalent, increasing from 32% to 45% fitment rate, while optional upgrades for navigation have fallen by 11 percentage points.

This product enrichment trend, coupled with broader inflationary pressures in recent years, has driven the overall increase in car retail prices. As vehicle prices have risen and spending on options has moderated, the share of options revenue as a percentage of the total retail price has naturally decreased to around 6%, with an average of 2.9 options now purchased per car.

Despite this downward trend in average spend per vehicle, car options remain a significant market force. In 2023, with 9.1 million passenger cars registered across the EU5, and an average of €2,761 spent on options per car, the total revenue generated by optional features reached an impressive estimated €25 billion. This figure underscores the enduring importance of car options as a revenue driver for OEMs.

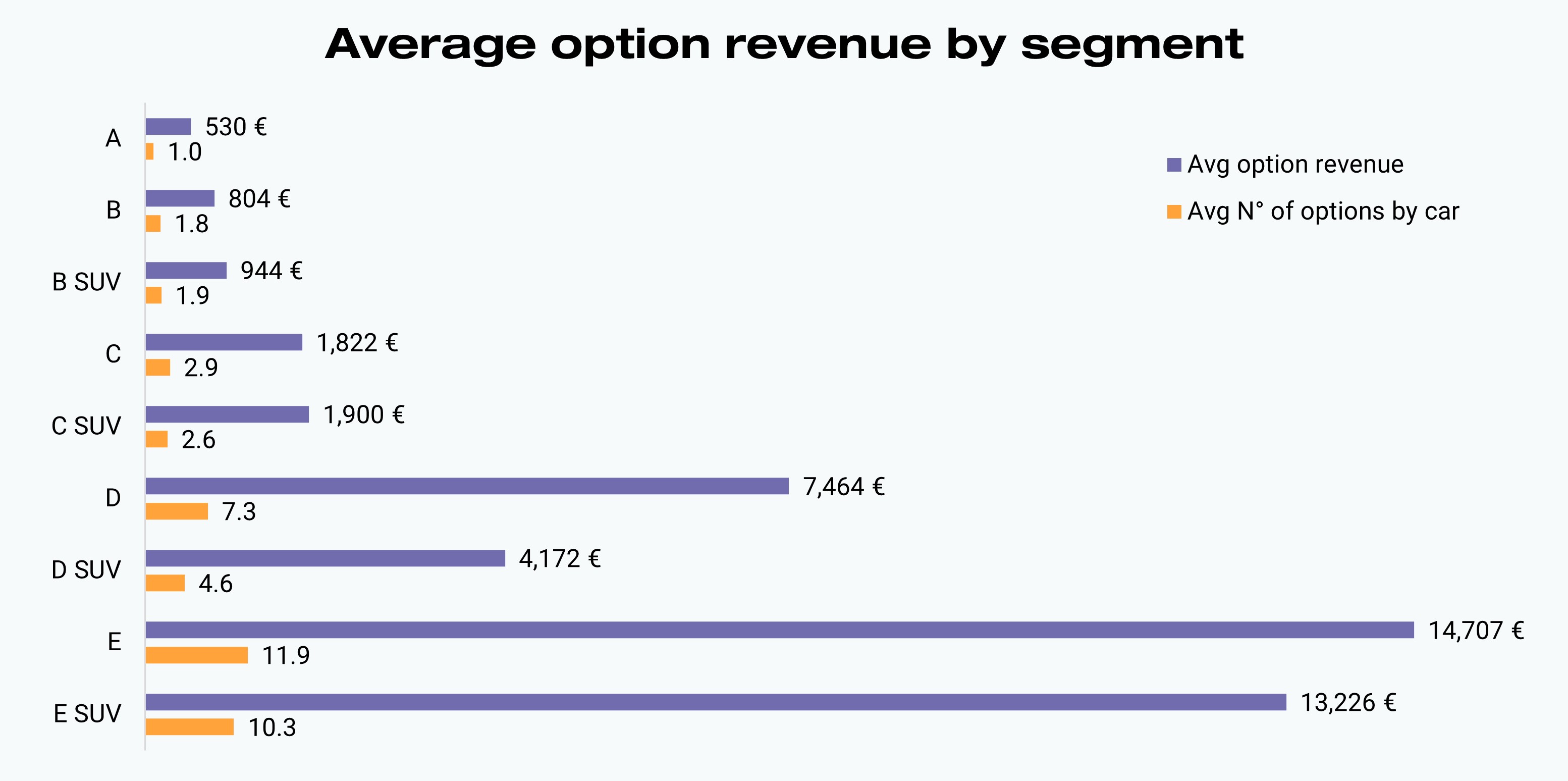

Segment-Specific Option Preferences

The revenue generated from car options exhibits considerable variation across different vehicle segments. In the smaller A and B segments (city cars and subcompacts), option revenue tends to be lower, typically below €1,000 per vehicle, with fewer than two options selected on average. As we move up the vehicle segments, option spending demonstrates a near-linear increase. Each step up in segment size correlates with roughly double the spend on options, accompanied by both a greater number of options chosen and a higher average price per option.

In the A segment, the average price per option hovers around €500. In contrast, in the larger E segment (executive cars) and E SUV segment (executive SUVs), the average price per option ranges between €1,200 and €1,300. Furthermore, the contribution of option revenue as a percentage of the retail price also escalates with vehicle size. Starting at a modest 3-4% in segments A and B, it rises to 5% in the C segment (compact cars), and dramatically increases to 18% in the E segment.

Interestingly, within the D (large family cars) and E segments, the average expenditure on options for SUVs is actually lower than that for conventional body styles (sedans, wagons). This anomaly can be partially explained by the differing sales mix of mainstream and premium brands within these segments. In the D SUV segment, premium brands represent 58% of total sales (YTD July 2024 registrations), whereas in conventional D segment body styles, premium brands account for a larger 72% share. Premium brands, as we will explore further, typically drive higher option uptake.

Option preferences also vary significantly by segment. For instance, in the A segment (city cars), rear parking sensors consistently rank among the top three most frequently selected options across all EU5 countries. Their enduring popularity in this segment highlights that even for compact city cars, rear parking assistance is perceived as a valuable and desirable feature, despite not always being included as standard equipment.

Brand Strategy and Option Uptake

Analyzing average option revenue by brand for the top 10 manufacturers in the EU5 reveals distinct strategic approaches to car options.

German premium brands – Mercedes-Benz, Audi, and BMW – demonstrably rely more heavily on optional features as a revenue source. These brands generate an average of between €7,000 and €10,000 in option revenue per vehicle, with customers selecting between 7 and 10 options per car. Notably, Mercedes-Benz leads this group, generating an average of €10,584 in option revenue per vehicle, significantly outpacing its premium competitors.

Source: JATO Transaction Analysis orders 5MM YTD July 2024 – Brands selected: Top 10 brands passenger cars in the 5MM in order by ModelMix registration YTD Jul 2024. Comparison of car option revenue across top automotive brands in the EU5.

In contrast, mainstream brands generally exhibit lower option revenue per vehicle, ranging from slightly under €1,000 to around €3,000. Toyota, for example, adopts a particularly lean option strategy, with a significant proportion of their vehicles sold without any additional options. On average, Toyota customers select only 0.4 options per vehicle. This reflects a strategic focus on value and simplicity in their product offering.

Powertrain and the Influence on Option Selection

The increasing market penetration of new energy vehicles, particularly battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs), adds another layer of complexity to the car options landscape. Transactional data from 2024 (YTD) indicates that PHEVs and BEVs, on average, exhibit higher option uptake rates compared to vehicles with conventional internal combustion engines (ICE).

Interestingly, while BEV trim structures tend to be less complex, potentially leading to fewer available options compared to ICE vehicles, the average price per option for BEVs is generally higher, averaging around €1,006 per option. This suggests that options offered on BEVs are often higher-value, technology-focused features.

Analyzing PHEV data in conjunction with registration figures reveals a strong influence from German premium brands, such as Mercedes-Benz, Audi, and BMW, in this segment. These marques constitute a significant 38% of the PHEV market mix and, as previously discussed, are associated with higher option uptake rates. This premium brand presence largely explains the elevated average option revenue observed for PHEVs.

Examining specific option choices by powertrain reveals further nuanced trends. For example, heat pumps rank as the third most popular option for BEVs, with an average price of nearly €1,000. This trend can be interpreted as a reflection of BEV owners’ heightened awareness of energy efficiency and their willingness to invest in features that enhance vehicle sustainability and range, particularly in colder climates.

Source: JATO Transaction Analysis Orders 5MM YTD July 2024. Analysis of car option preferences across different vehicle powertrains.

Strategic Imperatives: Balancing Standard Features and Optional Upgrades

In the intensely competitive automotive market, characterized by new entrants and ongoing pressure on profitability, pricing and car options remain pivotal strategic levers. While OEMs have long leveraged options to bolster revenue, the current focus is on optimizing the balance between standard features and optional upgrades. By strategically curating this mix, brands can achieve production efficiencies while effectively catering to evolving customer needs and desires for personalization.

Car options play a crucial role in enhancing the customer experience by providing greater customization possibilities. Leading the way in this approach are German premium brands, who offer extensive and sophisticated option catalogs. This strategy, grounded in a deep understanding of customer preferences, is designed to maximize additional revenue streams.

Conversely, some manufacturers are adopting a more streamlined option strategy, embracing an ‘all-inclusive’ product philosophy by incorporating a richer set of features as standard. Toyota, with its limited option offerings, exemplifies this approach. Similarly, BYD includes nearly all paint options as standard, simplifying the purchasing process. This ‘all-in’ strategy can enhance perceived value and, when coupled with production cost optimization, can significantly improve a product’s overall market competitiveness.

Determining the optimal option strategy for a brand seeking to maximize revenue requires a granular analysis of cost structures at the model level, feature by feature. Crucially, it necessitates a thorough understanding of customers’ willingness to pay for each potential addition. This detailed analysis will inform strategic decisions about which features are best positioned as optional upgrades and which should be integrated as standard equipment. In practice, the most effective option strategies for most OEMs are likely to fall along a spectrum, blending elements of both the extensive premium approach and the streamlined mainstream model.

*Main premium brands: Alfa Romeo, Alpina, Audi, BMW, DS, Genesis, Jaguar, Land Rover, Lexus, Maserati, Mercedes, Nio, Polestar, Porsche, Tesla, Volvo, Xpeng

Navigate evolving automotive market dynamics with JATO’s four decades of industry expertise.

Leveraging a global team of consultants, analysts, and automotive specialists, JATO provides customized solutions to address the unique challenges of our clients. Stay ahead of automotive market disruptions and capitalize on emerging opportunities. Learn more: https://info.jato.com/analysis-and-reporting

Seeking bespoke reports and industry insights?

Get in touch with us.

Complete the form and detail your specific needs so our expert team can best address your request.