The California New Car Dealers Association (CNCDA) has recently released its California Auto Outlook for the first quarter of 2024, offering a comprehensive look into the state’s automotive market. This report, powered by data from Experian Automotive, reveals intriguing shifts in consumer preferences and brand performance within the realm of Recent Automotive Releases.

[ ](California Auto Outlook Q1 2024 Report Cover – Automotive Sales Trends)

](California Auto Outlook Q1 2024 Report Cover – Automotive Sales Trends)

Tesla’s Grip on California Fades as Traditional Brands Re-emerge

One of the most notable findings from the Q1 2024 report is the changing dynamics surrounding electric vehicle (EV) giant Tesla. While still a significant player, Tesla’s vehicle registrations in California have experienced a year-to-date (YTD) drop of 7.8 percent. This follows a previous quarterly decline of 9.8 percent, indicating a potential trend. In contrast, traditional automotive manufacturers are capitalizing on recent automotive releases in the plug-in hybrid (PHEV), hybrid, and battery electric vehicle (BEV) sectors.

Toyota, a long-standing leader in the California market, has increased its market share to an impressive 16.6 percent. Honda also demonstrated strong growth, capturing 10.5 percent of the market. Tesla, while still holding a substantial 11.6 percent share, is seeing its dominance challenged by these established brands and their array of recent automotive releases.

Franchised Dealers Drive Growth in Alternative Powertrains

The report emphasizes a significant shift in consumer behavior regarding where they purchase alternative powertrain vehicles. Sales of BEVs through traditional franchised dealerships have surged by 14 percent compared to the previous year. Conversely, direct sellers of EVs have seen a three-point drop in sales. Franchised dealers now account for over 66 percent of the combined sales of BEVs, PHEVs, and hybrids. This trend suggests that Californian consumers are placing their trust in the established networks and service offered by local dealerships when considering recent automotive releases with alternative powertrains.

David Simpson, CNCDA Chairman, highlights the importance of trust and customer service built by franchised dealers over decades. He contrasts this with the Tesla sales model, suggesting potential customer dissatisfaction with service levels. This preference for franchised dealerships indicates a strong value placed on established relationships and reliable service when purchasing recent automotive releases.

California’s Overall Market Growth Slower Than National Average

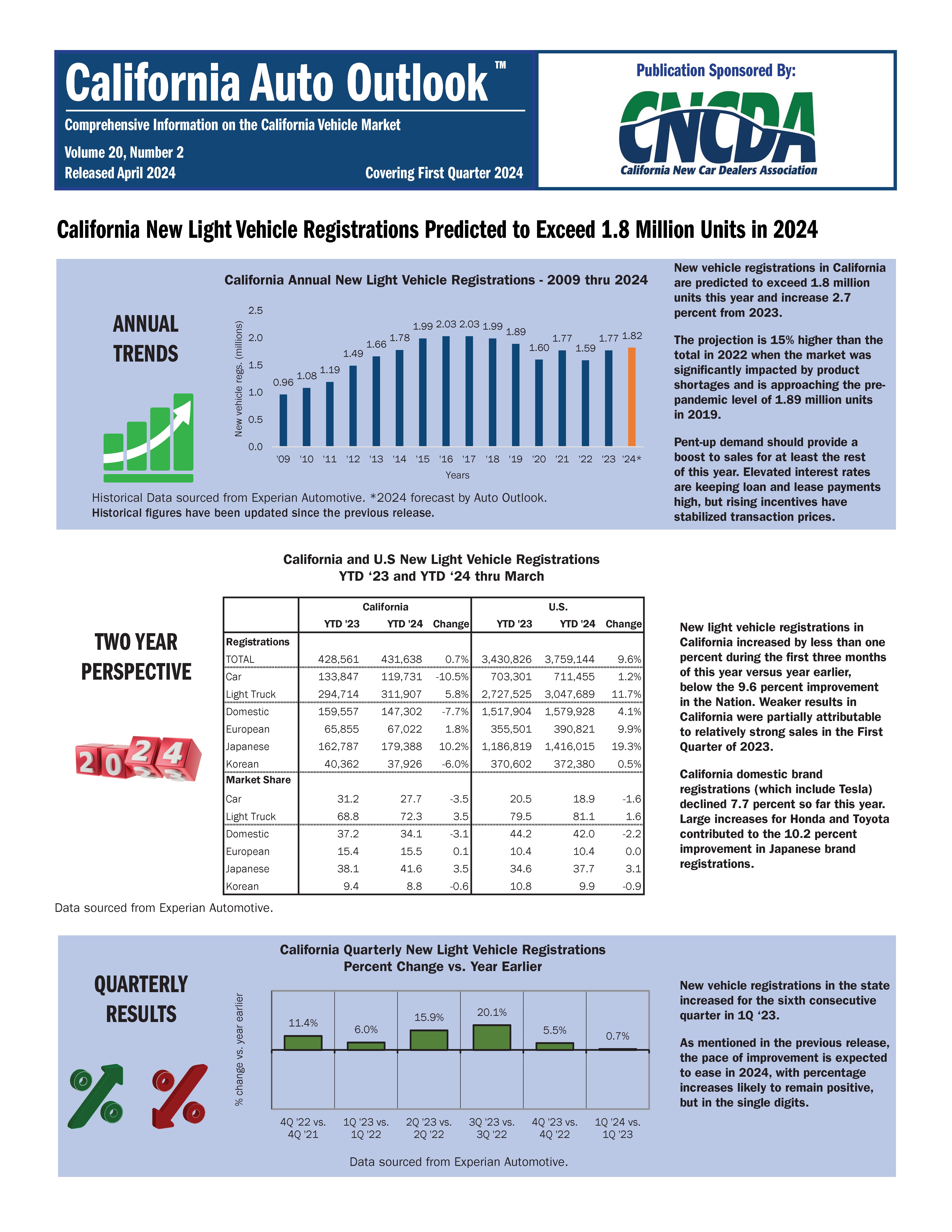

While California’s new vehicle registrations showed a slight increase of 0.7 percent in Q1 2024, marking the sixth consecutive quarterly increase, this growth lags behind the national average of 9.6 percent. This slower pace in California is partly attributed to strong sales figures in the first quarter of 2023. The report predicts that California’s overall improvement will moderate in 2024, with registrations expected to exceed 1.8 million units, but the growth rate will likely remain in the single digits.

Toyota and Honda Lead in Brand Performance

Toyota has solidified its position as the top brand in California, experiencing a 9.3 percent increase in registrations. Honda also demonstrated remarkable growth with an 18.6 percent jump YTD. In terms of top-selling models, the Toyota Camry and Honda Civic remain highly popular passenger cars. While the Tesla Model 3 was previously a top seller, it has slipped to third place in passenger car rankings. For light trucks, the Tesla Model Y, Toyota RAV4, and Honda CR-V are the top performers, showcasing the continued popularity of SUVs and trucks among recent automotive releases.

Dodge is another brand worth noting, experiencing a significant 76.2 percent increase in new registrations, driven by the introduction of the Hornet PHEV SUV, a notable recent automotive release in the hybrid segment.

Powertrain Trends: Hybrids Gain Momentum

The Vehicle Powertrain Dashboard within the report provides detailed insights into BEV, hybrid, and PHEV sales. Interestingly, California’s BEV market share has slightly declined for the second consecutive quarter, falling to 20.9 percent. Conversely, hybrid registrations have surged to 13 percent, up from 11.1 percent, indicating a growing consumer interest in hybrid technology among recent automotive releases. PHEV market share saw a minor increase to 3.6 percent.

Combined, alternative powertrain vehicles (BEVs, PHEVs, hybrids, and fuel cell) now account for 37.5 percent of the California market share, a significant increase from 11.6 percent in 2018. Internal Combustion Engine (ICE) vehicles still hold the majority share at 62.5 percent, but this is a slight decrease from the end of 2023.

California remains a leader in BEV adoption, representing 32.5 percent of nationwide BEV sales. However, the overall U.S. market share for BEVs is considerably lower at 7.4 percent in Q1 2024. While Tesla leads in BEV sales volume in California, their market share has decreased by 6.4 percent YTD. Mercedes and BMW have shown the highest increases in BEV sales percentages, indicating growing competition in the premium EV segment with their recent automotive releases.

Regional Differences and Model Segment Highlights

Northern California continues to be the leading region for BEV adoption, capturing 24.8 percent of the market share. Southern California’s BEV sales remain steady at 21.5 percent. Top-selling models across various segments in Q1 2024 include the Honda Civic, Toyota Camry, Tesla Model 3, Toyota Tacoma, Chevrolet Silverado, Toyota RAV4, Subaru Outback, and Lexus RX, representing a mix of established favorites and recent automotive releases.

Brands experiencing the most significant positive registration growth include Rivian, Dodge, Lexus, Lincoln, and Volvo, indicating shifts in brand popularity and the impact of recent automotive releases from these manufacturers. California’s brand registration trends differ from the rest of the U.S., where Toyota, Ford, and Chevrolet hold the top three positions.

Conclusion: A Dynamic California Auto Market

The Q1 2024 California Auto Outlook report paints a picture of a dynamic and evolving automotive market. While overall growth is modest, significant shifts are occurring within the powertrain landscape and brand preferences. The decline in Tesla’s market share, the resurgence of traditional brands with recent automotive releases in the EV and hybrid segments, and the growing preference for franchised dealerships highlight key trends shaping the California auto market. The rise of hybrid vehicles and the continued dominance of Toyota and Honda further underscore the evolving tastes of California car buyers in the realm of recent automotive releases.

For a detailed breakdown of the findings, you can access the full Q1 2024 Auto Outlook Report here.